For week of Feb. 23

The U.S. administration’s response to the Supreme Court’s ruling against IEEPA tariffs could overshadow economic data releases in the week ahead. We have noted before that the government has multiple options to reimpose those measures using other legislation.

And, in Canada’s case, an exemption for CUSMA compliant trade means most exports were already exempt from IEEPA tariffs with product specific section 232 tariffs (not impacted by the ruling) the main source of tariffs on Canada (Issue in Focus for more).

We continue to view maintaining CUSMA-related exemptions more important for Canada than the IEEPA ruling itself.

Canadian GDP growth appears to have stalled in Q4

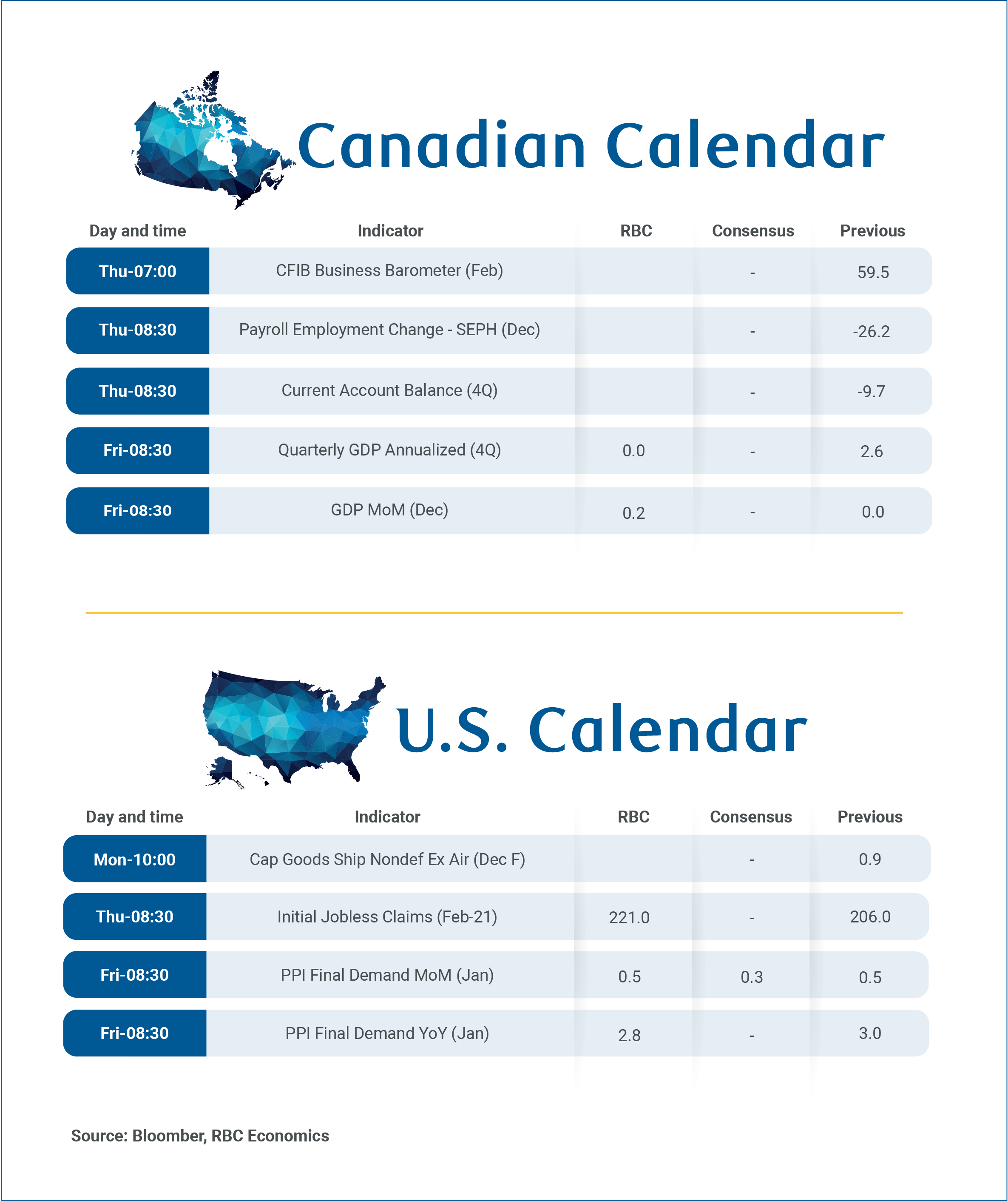

International trade uncertainty and volatility has been a persistent feature in the growth backdrop over the last year, but we expect a flat Q4 gross domestic product reading for Canada next Friday was in part due to temporary disruptions in the economy with signs of stronger activity late in the quarter.

Following two soft growth prints in October and November, we expect a 0.2% increase in December that would be slightly above Statistics Canada’s 0.1% advance estimate. That would leave Q4 tracking close to our (and the Bank of Canada’s) forecast for no growth after a 2.6% annualized increase in Q3.

The silver lining to a soft looking quarter is that most of the weakness was concentrated in October and November with industry reports for December mostly positive.

Manufacturing and wholesale sales surged 2.1% and 1.8%, respectively, as auto production bounced back from disruptions related to a semi-conductor shortage in November. Education services in December likely recouped more of the weakness from Alberta’s teachers’ strike in October after a partial bounce back in November.

Those disruptions—along with impact from a postal strike in October—combined to subtract almost three-quarters of 1% from annualized Q4 GDP growth, according to our estimates.

Still, soft spots remain. The manufacturing sector continues to struggle from U.S. tariffs. Home resales pulled back in December (and again in January), and retail sales were unchanged from November.

Rise in business investment but residential likely fell

We expect to see a pick-up in business investment in Q4 as key indicators like electrical equipment and parts’ imports rose.

Moderating trade uncertainty likely helped with stabilizing sentiment and investment intentions. Most companies surveyed in the BoC Q4 Business Outlook Survey didn’t expect further deterioration in the tariff and trade backdrop going forward.

Residential investment likely contracted after bigger increases in Q2 and Q3, given declines in home resales, construction and housing starts in Q4. Elsewhere, household consumption and net trade likely grew modestly although our tracking of RBC card spending data pointed to a drop-off in consumers’ buying momentum (especially among discretionary items) in January.

The BoC already assumed flat Q4 GDP in their January forecasts, and much of the weakness appears to have been due to one-off factors. In the meantime, labour markets continue to show signs of improving with the unemployment rate broadly edging lower.

With interest rates already bordering stimulative levels, we don’t think it’s likely or necessary for the central bank to cut again.

This report was authored by Assistant Chief Economist Nathan Janzen and Senior Economist Claire Fan.

Explore the latest from RBC Economics:

Canadian Inflation. Canadian CPI growth edged lower in January

Canada Trade Balance. Canada’s trade deficit narrowed in December to cap volatile 2025

Monthly Housing Market Update. Canadian homebuyers get cold feet, sellers out in force in January

Share these insights with your network:

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.